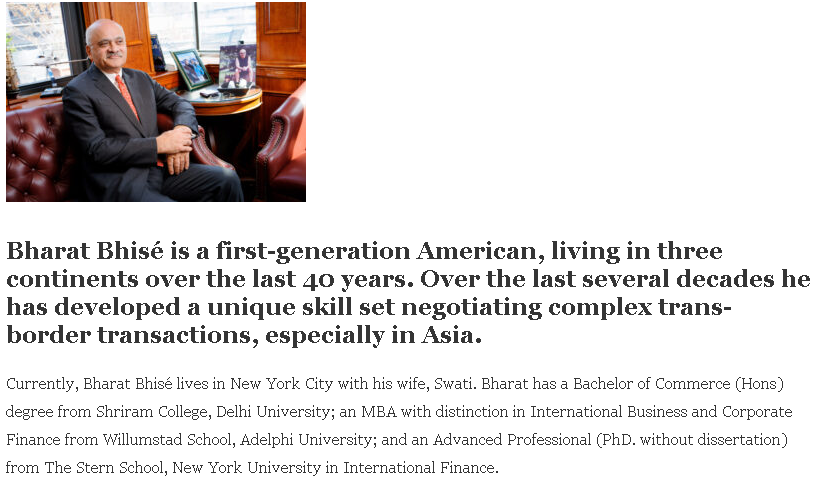

Bharat Bhisé is an investor and an international ‘dealmaker.’ Over the years, he has worked with many global brands.

However, many have filed for bankruptcy or are running from authorities. Currently, he is the CEO and founder of Bravia Capital.

From HNA to Vijay Mallya, Bharat has dealt with many disgraced businesses. However, when people think of Bharat, none of these names come to my mind.

Why? Because he has tried his best to make people forget about his shady associations.

That’s why the following review will take a deeper look at Bharat Bhisé and his involvement in different shady deals:

Multiple Lawsuits

Bharat Bhisé has been involved in multiple major lawsuits over the last few years. His company, Bravia Capital, has filed and faced several lawsuits over contracts and botched deals.

One of the lawsuits included allegations of fraud and perjury. In Bravia Capital Partners Inc vs Fike, Bharat Bhisé’s company had received allegations for producing false documents, lying under oath and defrauding the court.

The lawsuit was filed in the District Court, Southern District of New York. While the court found many inconsistencies and grave mistakes in Bravia Capital Partners’ testimonies, it didn’t find any evidence of fraud.

Fike had asked the court to sanction Bravia in the form of:

- Dismissing their declaratory judgment complaint

- Enter a default judgment against Bravia on her counterclaims

- Set reasonable attorney’s fees

You should keep in mind that Bravia Capital is a major capital firm and has the purchasing power to employ the best of the best attorneys.

Nevertheless, the Court found that Bharat Bhisé had submitted a document with a forged signature. Hence, it decided to order him to show cause why the Court should not sanction him personally.

The case occurred in 2015 and apart from a few legal dockets, there isn’t much information available on the lawsuit. Notably, during the case, Bharat’s company had deleted several crucial documents and emails.

Maybe this is another result of Bharat’s PR efforts; who knows?

Moreover, this is not the only lawsuit he has been involved in.

Second Case Involving Bharat Bhise

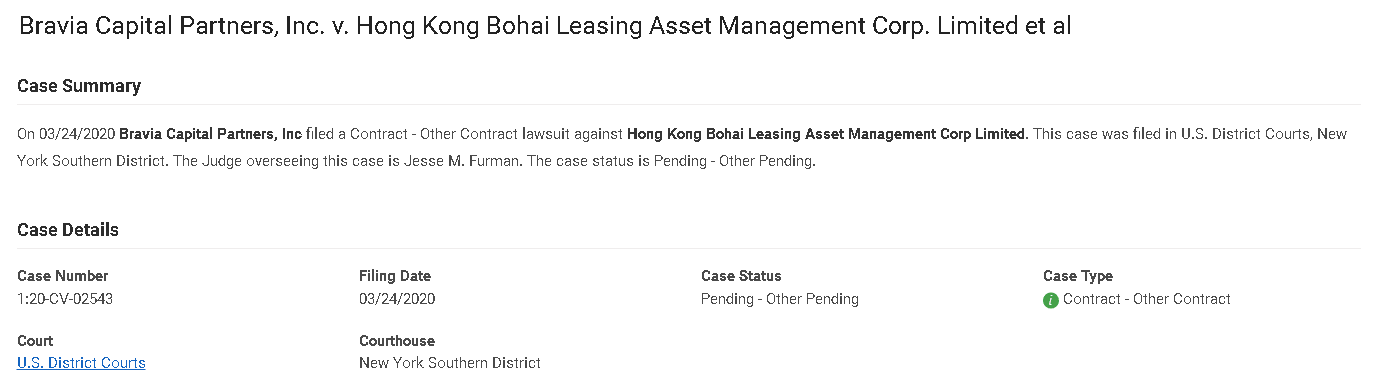

In 2020, Bravia Capital Partners Inc. filed a lawsuit against Hong Kong Bohai Leasing Asset Management Corp Limited. They filed this case in U.S. District Courts, New York Southern District.

It is a case regarding contracts and related disputes. The case is still pending in the court.

Bharat Bhisé has never been free from controversy. But that’s not all.

Before showing interest in politics, Bharat Bhisé was working in China. There, he was part of a humongous scam. More on this in the next section of this review:

Involvement in Now-Defunct HNA

HNA Group Co was a major Chinese conglomerate with multiple assets in China and overseas. There was a time when everyone was hailing this conglomerate as one of the fastest-growing companies in the globe.

However, its assets were seized by the authorities in 2020 as the company was buried under humongous debt.

Chinese authorities detained the chairman of HNA Group Co. in 2021, along with the CEO, Tan Xiangdong, for unspecified crimes.

The leadership of HNA had used the easy credit offered by the Chinese government during its boom to fund a myriad of overseas acquisitions. Some of their significant investments included buying stakes in Hilton Worldwide Holdings Inc. and Deutsche Bank AG.

In 2017, HNA was ranked 170 among the world’s Fortune 500 companies. But in 2018, the company owed $93 billion to its creditors.

Also read: Exposing Darren Ewert and Mike Dreher: Enagic MLM Scam

Now that most of its leadership is gone, very few people are discussing it. However, most people forget that Bharat Bhisé used to be a major stakeholder in this company.

Connections

During the Chinese firm’s rapid growth, Bharat Bhisé acquired a 30% stake. Bhise said he did it as a favor and received ‘no compensation’ for it.

This claim seems odd, considering that HNA is a Fortune 500 company and is among the largest in China.

As a major stakeholder, Bharat acted as a dealmaker for HNA Group Co. in many Mergers and acquisitions. He claimed they were never his shares and he was merely “holding them in trust.”

Bharat had managed George Soros’ 1995 investment in Hainan Airlines 600221.SS, which was HNA’s flagship asset then.

Furthermore, he was a board member of five HNA-invested companies, including Ingram Micro (a US electronics firm) and Avolon Holdings (an aircraft leasing company).

As the chairman of Bravia Capital, Bharat had co-invested with HNA in many of its overseas investments. These included Africa World Airlines, MyCargo Airlines and SeaCo, a marine container firm.

HNA and its Shady Ownership Structure

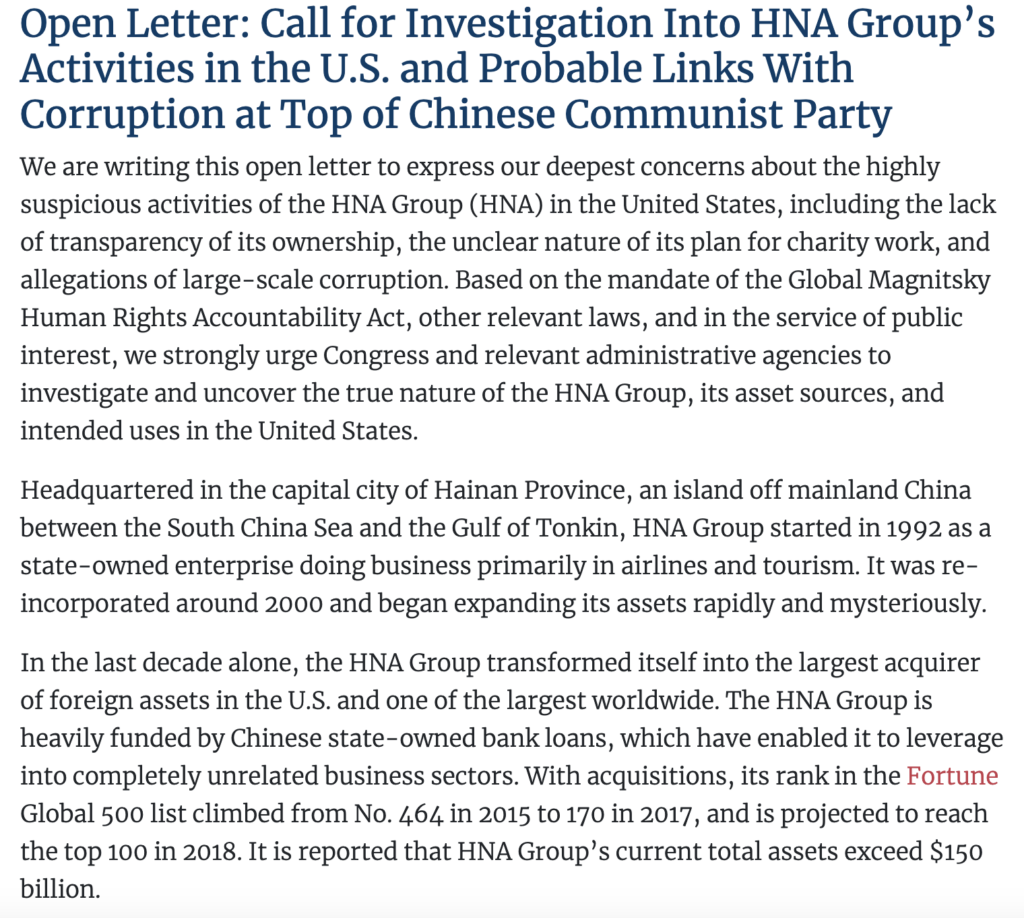

The downfall of HNA started when Geo Wengui, a fugitive Chinese billionaire, alleged that officials in the CCP and their relatives were undisclosed shareholders in HNA.

Also, he alleged that HNA had allowed Chinese government officials and their relatives to use the company’s aircrafts for ‘purely personal reasons’.

This prompted many people and authorities to question the ownership structure of HNA. Moreover, it made many people realize how suspicious the entire structure was.

The “Indian dealmaker” started attracting attention when he transferred his 30% stake in the company to an unknown person named “Guan Jun.” According to media reports, Guan had ties to one of China’s most influential government officials.

Guan had purchased Bharat’s stake from him in 2017.

The China Human Rights Accountability Center called for an investigation into this deal and shared several important details.

Kong-based businessman Bharat Bhise. Neither HNA nor Bhise revealed how the stake changed hands up to this transaction.

When asked how the deal took place, neither Bharat nor HNA disclosed any information. Both of them refrained from sharing information regarding the transfer of the conglomerate’s ownership.

However, the pressure kept increasing, and HNA had to release an open letter themselves. In their letter, they didn’t mention Guan. Instead, they claimed that Bharat’s stakes in the company had gone to a US-based charity.

Later, Bharat said that the company’s senior management is Buddhist and wants all the shares to go to charity at some point.

“Bharat Had sold his shares to Guan Jun, a mysterious person with no legal information available on him”

This meant that it was one of the most generous donations to a US foundation in the history of philanthropy.

Bharat Bhisé never explained how the ownership of his shares, which were worth billions, went to the donor Guan Jun. Guan’s registered address is a simple apartment, where reports found a trash-laden building.

Similarly, Guan Jun’s business address was the address of a street-side spa in a residential neighborhood. Certainly, the details were false, and Bharat and HNA hid something.

International media deemed Bharat and Guan’s shares shady and suspicious. HNA claimed that Guan didn’t work for the company, but media reports say that he served as co-chairman of HNA’s P2P lending platform.

Due to such dubious ownership, Bank of America decided not to do any business dealings with HNA. However, nothing came out after receiving all of these allegations. Bharat Bhisé roamed scot-free and has since moved on to other ventures.

Also, see how my team and I Exposed Cornerstone Bullion Fake Reviews & Chad Roach Scam Tactics.

As you can see, Bharat has been involved in one of the biggest corporate scams of the last few decades. Certainly, he didn’t want HNA’s notoriety to stick with his brand.

So, he started conducting interviews with different news outlets and publications.

In one of those interviews, he shared how his career got started. Initially, he used to work in sales when he was in India and moved to the US to pursue his MBA.

After completing his MBA, he got a management job there but returned to India a few years later.

This is where things get interesting.

Bharat Bhisé’s Dealings with Vijay Mallya

Bharat started working with the highly notorious Vijay Mallya when he came to India. For those who don’t know, Vijay Mallya (proclaimed offender) is facing fraud charges, such as embezzlement and money laundering in India.

Vijay Mallya owes $1.35 billion to Indian banks and fled to the UK after making his company bankrupt. Authorities allege that he has transferred $520 million to tax havens as well.

So, HNA wasn’t the first enterprise to work with Bharat, and it turned out to be a corporate scam. He had already worked with Vijay Mallya to gain the necessary experience.

Read How New York’s Rhinoplasty Surgeon Ruining Noses: Dr. Sam Rizk Reviews: She Could Not Stop Bleeding After $16,000 Rhinoplasty

Conclusion

From being a business partner of Vijay Mallya to being a stakeholder of the highly notorious HNA Group, Bharat Bhise has done some pretty shady deals.

He has also produced forged documents in Court. It is difficult to say whether he will face any consequences for his actions.

After all, he is extremely wealthy and has many connections. However, this little piece should raise some awareness about the ongoing corruption in our current corporate world.

Bharat Bhise

The Bravia Capital CEO has been a part of some of the most notorious business dealings in the world. He has many skeletons in his closet. From lying in the Court to selling all of his HNA shares to a mysterious entity, Bharat Bhise has done it all. Hopefully, the relevant authorities will start looking into this international “dealmaker”.

1

Pros

- Great network

- Political connection

Cons

- Corruption

- Forgery

- Offshore company

- Money laundering

- Bravia Capital

- HNA

- Vijay Mallya

- No Ethics

I think the US authorities should arrest this CCP pawn and get more information about their corrupt deals. That’s the only way to handle this situation. I don’t know about this Mallya guy but he sounds just as corrupt if not more. Everyone associated with HNA is behind bars. Bharat should be too.